Financial and lending markets have now shifted from manual loan origination to automated loan origination. There are still many institutions that have started the shift or are in the process. Customers who want to take loans do not want to stand in long queues and now want to access the automated loan processes to save their time and have a better experience. If you are a lending company, fintech startup, bank, NBFC, or any other lending organization or lending company, having a digital loan origination system will help you scale easily, reduce risk, and also provide a faster and better lending experience for your customers.

In this blog, we will talk about the digital loan origination system. Furthermore, we will see how this will change the lending process and why NBFCs need a loan origination system for better management of operations.

Key facts about the Digital Loan Origination System

- Experts valued the global loan management software market at $5.9 billion in 2021 and project it to reach $29.9 billion by 2031, growing at a CAGR of 17.8% from 2022 to 2031. Allied market research findings.

- According to the 2024 MeridianLink State of Digital Lending report, many financial institutions experience a 60% decrease in funding times after adopting a digital lending platform.

- According to Finezza, using lending software can reduce operational costs per loan application dramatically. Cloudbakin claims that using digital LOS lowers cost-per-loan application: in one case, from ~INR 500 to INR 100–150. Cloudbakin.

- With the Digital Loan Origination System, institutions spend 30–50% less time on decision-making, which helps improve margins. Bank business.

- IDC predicts that banks and lending institutions will invest more in the loan origination systems, moreover, data shows that spending is estimated to go from $7.3 billion in 2021 to $9.7 billion in 2025. IDC.

What is digital loan origination software?

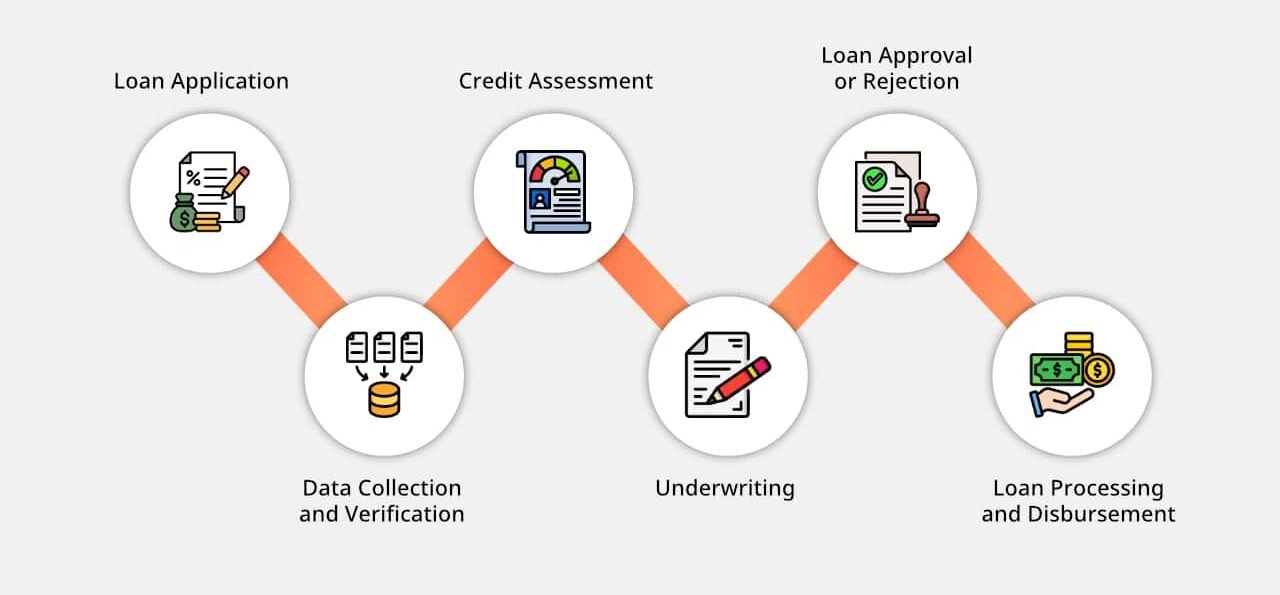

Digital loan origination software is used by banks, NBFCs, and lending institutions to save time and automate the manual steps for the loan applications, Moreover, it is a digital software that does not involve any paperwork. Loan origination software saves time, provides faster loan approval, loan disbursal, and helps streamline the loan lifecycle easily without any hassle and manual errors.

Why every NBFC needs a digital loan origination system in 2025?

To provide a better customer experience, save time, reduce errors, better decision-making, reduce operational costs, demands for fast and automated loan processes, there is no other choice than upgrading to digital loan origination software to attract more customers, be up-to-date with the technology, and provide a seamless experience to the customers and employers. Chasing digital loan software is the best choice for the NBFCs.

Top reasons for NBFCs to use the digital loan origination system

Quick loan origination

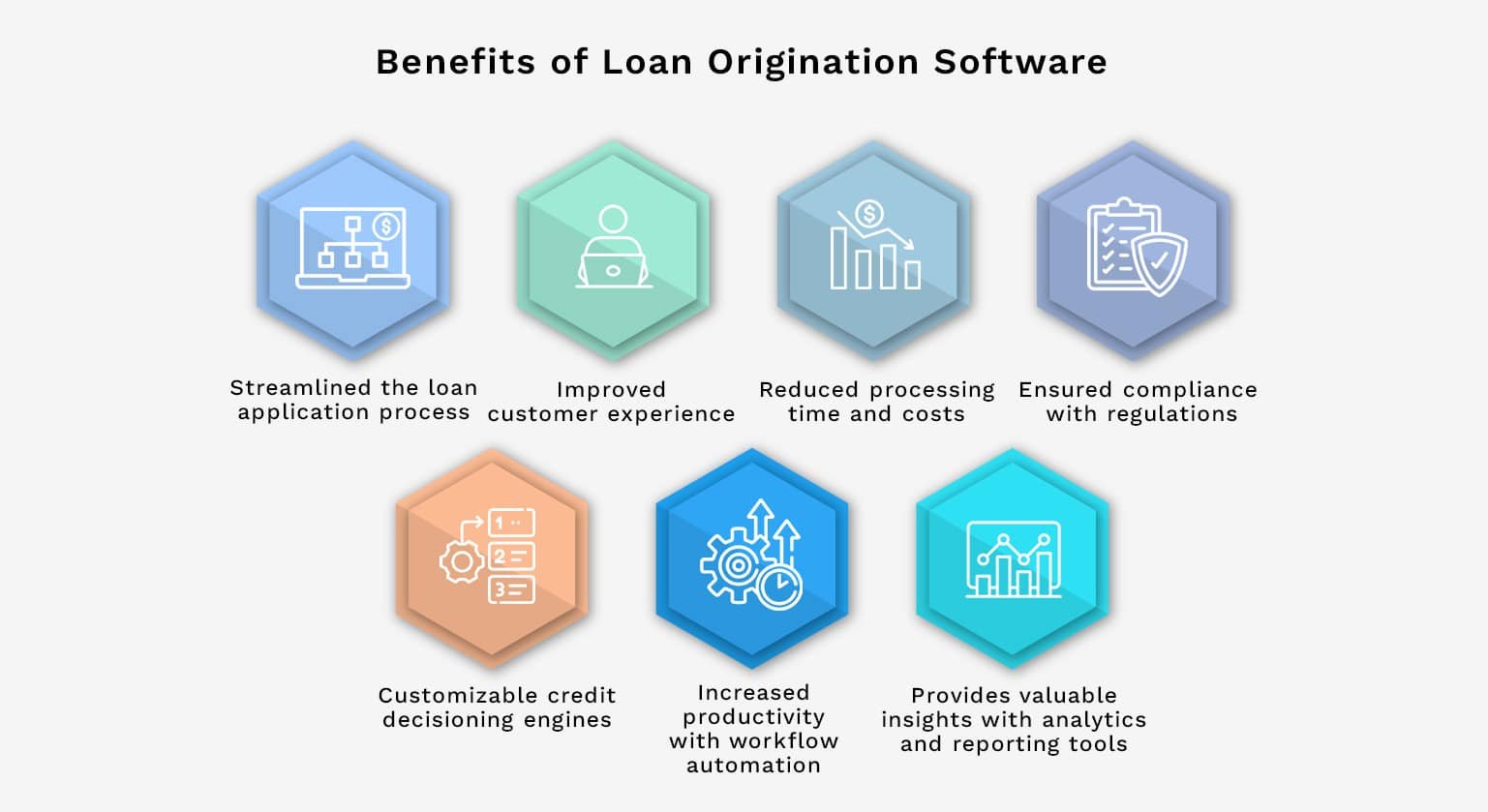

Automation speeds up every step, allowing lenders to approve loans quickly and disburse them in less time. Earlier, the process took days, but now lenders can approve loans within minutes.

Better compliance

Digital loan software can track the data flow, logs, documentation, and reporting to have a full record of the customers, moreover, digital loan origination software can easily follow RBI guidelines.

Reduce the manual errors

Automation eliminates manual errors in the loan origination steps.

Customer experience

Customers will have a seamless experience where they will have faster loan approval, faster document upload, online application, easily accessible application, easy editing, and updates.

Centralized data

Data integration is the top benefit for any NBFC. The GST data, bank statements, credit scoring, income, and behavior patterns are all seen under one software; furthermore, this saves time and helps make better decisions.

It is more scalable

More applications are handled at one go. You do not need extra employees to manage the applications; furthermore, hundreds or thousands of applications are managed easily without any burden.

Lower investment and operational costs

Automation will reduce the operational cost, and less money will be spent on the hardware, workforce, and other resources.

Key Benefits of Loan Automation for NBFCs & Customers

| Benefits of loan software | Benefits for banks and NBFCs | Benefits for the customers |

| Fast loan processing | Approval time reduced from days to minutes | Quick approval of loans and disbursal |

| Reduction in errors | Fewer to no manual mistakes | The application is accurately updated |

| Less operational spend | Save money on paper, other resources, and manpower | Do not have to visit the branch, can do it from the comfort of home |

| Risk management | AI-driven credit scoring | Fair evaluation of the customer’s profile |

| More compliance | Automated backups for the application ensure the RBI-aligned processes | Secure and trustworthy |

| scalibility | Manage thousands of applications | Smooth experience during the peak times |

| Fraud detection | Automated checks | Secure identity and document handling |

| Digital convenience | Less workload | Instant insights for your application |

| Improved decision-making | AI-driven and real-time data analytics decision-making | Instant insights |

| Customer satisfaction | Repetitive customers | Seamless experience in the loan journey |

Why Digital Loan Origination System Adoption Will Surge in 2025?

A loan origination system is adopted by almost all lending institutions. A few reasons why organizations are choosing to shift towards the digital Loan origination system are

- With the introduction of AI, it has become much easier for employers as well as customers to ease out the loan origination lifecycle.

- A rise in demand from outside of the tier 2 and tier 3 cities has shifted the banks and NBFCs towards digital loan automation; moreover, more applications are managed easily on the software.

- Onboarding for the customer has become paperless. It is much faster and more reliable.

- RBI is pushing for the digital transformation to have more transparency related to the applications.

- The process has become much faster. A cloud-based system has helped customers to access their application from anywhere; furthermore, it has improved the customer experience, helps companies easily manage loan applications, and delivers better performance across different processes.

Quote: Why NBFCs Need a Digital LOS in 2025

“Digital Loan Origination Systems are now mission-critical for NBFCs—cutting processing time by over 50%, reducing underwriting errors, and improving compliance as regulations tighten in 2025.”

Conclusion

In 2025, if you do not have a digital loan origination system in place, then you will be out of the business. For the NBFCs and other lending institutions, it is important to have an automated loan origination software to attract more customers and make the most of it.

Jaguar Software India is a leading company that provides loan software to banks, NBFCs, and other lending firms, moreover, we have been in the business for many years, and our product is of the highest quality. If you want to know more about Proust and the services we offer, feel free to contact us on the information given below.

Contact details

Company Name – Jaguar Software India

Phone No – +919666107000

Address – 18-19, Rajinder Nagar, Police Lines Road, Jalandhar, India

Email – info@jaguarsoftwareindia.com

Website – https://jaguarsoftwareindia.com/

Frequently asked questions

Which company provides the digital loan origination system?

Jaguar Software India provides the digital loan origination system for the NBFCs, Banks, and other lending firms.

How much does it cost to use a digital loan origination system?

Cost depends on the services you want to avail. There are different software programs for different fields. Our expert can understand your needs and then help you out with the right type of loan automation software.

What are the benefits of using a digital loan origination system?

No manual errors, AI-driven decision making, faster loan approval and disbursal, better compliance, seamless customer experience, and many more.

Will it rescue the operational cost for the NBFCs?

Yes, it will rescue the operational cost for the NBFCs. Automation reduces the need for extra workforce and resources.

Can small or midsize companies opt for the loan origination system?

Yes, organizations of any size can implement a loan origination system.

Is a Digital LOS in line with the RBI rules and regulations?

Most current LOS platforms integrate KYC regulations, CKYC, bureau checks, audit trails, and data security features to ensure RBI compliance.

What are the significant trends for LOS adoption in 2025?

The major trends are:

- Underwriting powered by AI

- E-KYC combined with Video KYC

- Instant risk scoring

- Fully mobile loan processing

- Cloud-native, API-first architecture