,India’s financial sector is revolutionized with the introduction of auto finance loan software. As more and more borrowers are applying for the loan process online, rather than choosing to visit the branch physically, it has put extra pressure on the officials to manage thousands of applications, without degrading the customer experience. NBFCs are under continuous pressure to complete all the steps in the shortest possible time.

This is where the AI-powered loan management software has enabled them to go through the applications much faster and has created a huge impact.

Loan processing time is reduced by half due to the presence of AI and automation in the loan management systems. In this blog, we will talk about how India’s NBFCs Are Using AI-powered loan Management Software to Cut Processing Time by 70% and will look at the benefits for the lenders and customers.

Key Facts

- By using AI / ML–based underwriting tools, they cut SME loan processing time by 60%, reducing the approval cycle from 7.5 weeks to 2.5 weeks. The Financial Express.

- According to a whitepaper, AI-powered document verification reduces loan disbursal cycles by 40–60%. Itech India

- An AIdriven system reportedly reduced loan processing times by 60% in the digital lending operations of NBFCs. Mihup

- A research paper finds that AI dramatically shortens the loan approval cycle in rural NBFCs — underwriting decisions are made in “minutes” instead of days or weeks, thanks to automated identity checks, NLP, and fraud detection. Advances in consumer research.

- One process step, such as property valuation, showed turnaround time reduced by 80% through AI tools. iTech India.

What is an AI-Powered Loan Management system?

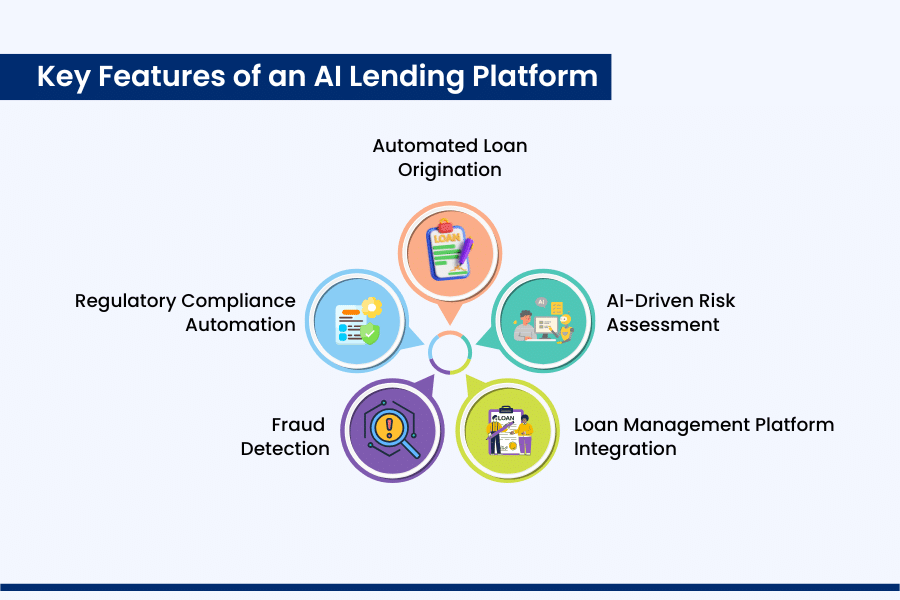

An AI-Powered Loan Management System is a software that is used to manage the loan applications of borrowers. The loan management system automates the different steps involved in loan processing. It uses its AI capabilities and machine learning techniques, automating the repetitive steps and using analytics to make faster and accurate decisions.

NBFCs’ dependence on AI-Powered Loan Management System

There are a few reasons for this :

Increase in the Number of Loan Applications

As the process has shifted from manual to digital, more people are applying for the loans. NBFCs need software that can handle hundreds and thousands of applications without showing any delay for a good customer experience.

Rising competitions

There is increased competition in the leading field. Other companies are using the best software and services to not lose the customer. In such a case, NBFCs need the best software to not lose their clients nd outperform other software.

Cost Efficient

The manual lending process involves a lot of workforce. By using the loan management system, you cut down on extra hiring, as very less or no manual work is left. This will help to reduce the operational cost as no extra hiring is required.

How AI Helps NBFCs Cut Loan Processing Time by 70%?

Let us look at the points to understand how the cut down on the loan processing time

Faster KYC and document verification

Manually, it took 2-4 days to check the documents and perform KYC with the Loan Management System. With AI in the picture, all the steps are being done in minutes or a maximum of 1-2 hours. It uses automation and machine learning to check instantly and make a decision.

AI and credit checks

Previously, it took a lot of time to check the credit history of the borrower. With an AI-based system, the CIBIL scores, GST return, Tax, and the behavior of the customer are done in minutes. NBFCs can know better about their customers, loans are approved faster, and less chances of any error. This task is done in seconds, if not minutes.

Easily detect the fraud

An AI-powered loan management system is capable of detecting duplicacy, fraud, fake documents, and wrong IP addresses, moreover, this helps the NBCs to reduce the risk of turning into NPAs.

Automating the repetitive tasks

Automation handles tasks like data entry and eligibility checks, reducing manual work and speeding up the loan process. Previously, all these tasks required a lot of time, from 2 to 5 days.

Smart Decisions

AI-powered systems help in smart decision-making. They can evaluate the customer profile and decide whether to give credit to customers or not.

Faster loan approval and disbursement

AI approves and disburses loans faster by automating every step, giving borrowers early access to their funds.

How does AI-Powered LMS improve operations in NBFCs?

| Process or features | Manual Loan Processing Time | With AI-Powered LMS | Time Saved |

| Document & KYC Verification | 20-60 hours | 10-15 minutes | 70-80% of document verification |

| Credit Scoring, Risk Assessment, and Regulatory Compliance | 3-4 hours | 1-2 minutes | 80% faster |

| Data Entry & Validation | 2-3 hours | Automated, 5-10 minutes | 100% elimination |

| Fraud Detection | depends. Generally, it takes a lot of time | Frauds are detected in real time | 100% faster |

| Auto Loan Origination | 3-4 working days | Instant approval or within 1hour. | 60-90% faster than manual loan approval |

| Loan Disbursement | 1-2 days | 10-30 minutes | 70-80% faster than the manual loan disbursement |

Quote: Key Insight

AI has turned loan processing from days to minutes, making approvals faster and smarter.

Conclusion

Loan management software is a must-have for all NBFCs. They make the lending process much easier and provide the best customer experience.

If you are a lending firm or a fintech company, or an NBFC, we at Jaguar Software India provide the lending solution for NBFC, banks, fintech startups, lending institutions, and other organizations that are in the lending business. We provide customized loan management software at reasonable prices and according to the needs of the customer. Feel free to visit the details mentioned below.

Contact details

Company Name – Jaguar Software India

Phone No – +919666107000

Address – 18-19, Rajinder Nagar, Police Lines Road, Jalandhar, India

Email – info@jaguarsoftwareindia.com

Website – https://jaguarsoftwareindia.com/

Frequently Asked Questions

Which company provides the AI-powered loan management software?

Jaguar Software India provides the AI-Powered loan management software at the most reasonable prices.

What are the real benefits of the AI-Powered loan management software?

The top benefits for the NBFCs are a reduction in operational costs due to automation of repetitive tasks. It brings more accuracy and reduces human errors by a huge margin. Transparency and quick processing times keep customers satisfied. It is highly scalable to manage many applications simultaneously. It provides better compliance as well with the regulatory bodies like the RBI.

How is AI used in Loan Processing?

AI, along with machine learning, helps make faster, better, and more informed decisions. AI-powered loan management systems use analytics to understand customers’ behavior and make well-informed decisions to avoid any fraud, turning into an NPA.

How do financial institutions use AI in the process of credit scoring?

It uses AI and ML to learn about the CIBIL, credits, loans, and repayment history in less than a minute and comes to a decision to credit the customer or not. It finds out how likely the user is to or will pay back the loan or EMI on time.

Can AI-Powered systems help NBFCs reduce the loan processing time?

Yes, it reduces the processing time by 50-60 percent. When there is no paperwork or manual checks and everything runs on AI or ML automation, the system completes the entire process in 20–30 minutes if your documents are valid and updated.

Can small NBFCs use the AI-Powered loan management software?

Yes, all the firms can use the software irrespective of their size and lending capabilities.

How much does it cost to get the loan management software?

At Jaguar Software India, you get these AI-Powered loan management software at lower prices and of the highest quality, furthermore, many factors determine the exact price, and our experts understand your needs and suggest the right software and pricing.

Does AI help reduce loan defaults?

Yes. AI analyzes customer behavior, spending patterns, revenue stability and historical repayment trends to predict default risk. This helps NBFCs approve secured borrowers and reduce bad loans.