In the fast-paced world of finance, today’s consumers are seeking almost immediate satisfaction -and auto lenders are no exception. No longer must car buyers wait weeks for approvals and disbursements after they are squeezed behind the wheel. With the introduction of Auto finance software and end-to-end Digital Auto Finance Solutions, lenders are revamping the speed and agility in terms of processing loans. Digital offerings are changing the auto lending experience – whether you’re a consumer who’s itching to drive off the lot fast, or an organisation that wants to streamline its workflows. Research and industry reports indicate that digital platforms can dramatically accelerate turnaround times, increase customer satisfaction and streamline compliance and risk assessment processes — at a lower operational cost. In today’s blog, we are going to dig deeper into the acceleration of digital auto finance solutions in loan disbursement with industry data and comparative insights, key facts and experts’ perspectives.

The Need for Speed in Auto Loan Disbursement

There are many manual and strenuous processes in the traditional auto loan process – documentation, verification, credit scoring, risk analysis & approval and so on, till the actual disbursal of a loan. These processes might take anywhere from a few days to weeks and create a hassle for both the borrower and lender. Modern auto loan software drives digital auto finance platforms that automate these processes and drive efficiency in ways that were never before possible.

Here’s why speed matters:

- Customer Demands: The 21st-century customer is attracted to frictionless online experiences. Research shows more than 55% of those who have borrowed online went in that direction because the process was fast and easy!

- Competitive edge: Lenders who use digital will stand out in turnaround times.

- Operational efficiency: Simultaneous integration of auto finance software leads to less paperwork and errors, plus fewer manual overheads.

Key Benefits of Digital Auto Finance Solutions

Let’s break down the main advantages that digital auto financing brings to the table:

- Quick Processing and Money Disbursement: Automated processes mean faster verification and credit scoring.

- Live Tracking: Know where the loans are at all times.

- Increased Approval Rates: Use of AI and analytics can help identify those who are actually creditworthy, even when making loan decisions based on nontraditional points.

- Lower Opportunity for Human Errors: By reducing the repetitive work performed manually by humans to a bare minimum.

- Better Compliance: Total quality is delivered to our clients while ensuring compliance with the latest standards.

Key Facts at a Glance

- Digital auto financing platforms like Maruti Suzuki Smart Finance have already processed over 25 lakh loans worth over Rs 1,70,000 crore — an indicator of both scale and impact ETAuto.com

- Approximately 40 per cent of buyers use digitised processes to apply for auto loans when shopping. V3Cars

- Total loan disbursals for digital lending increased by 21% y-o-y in toto suggesting growing trust and adoption. Business Standards

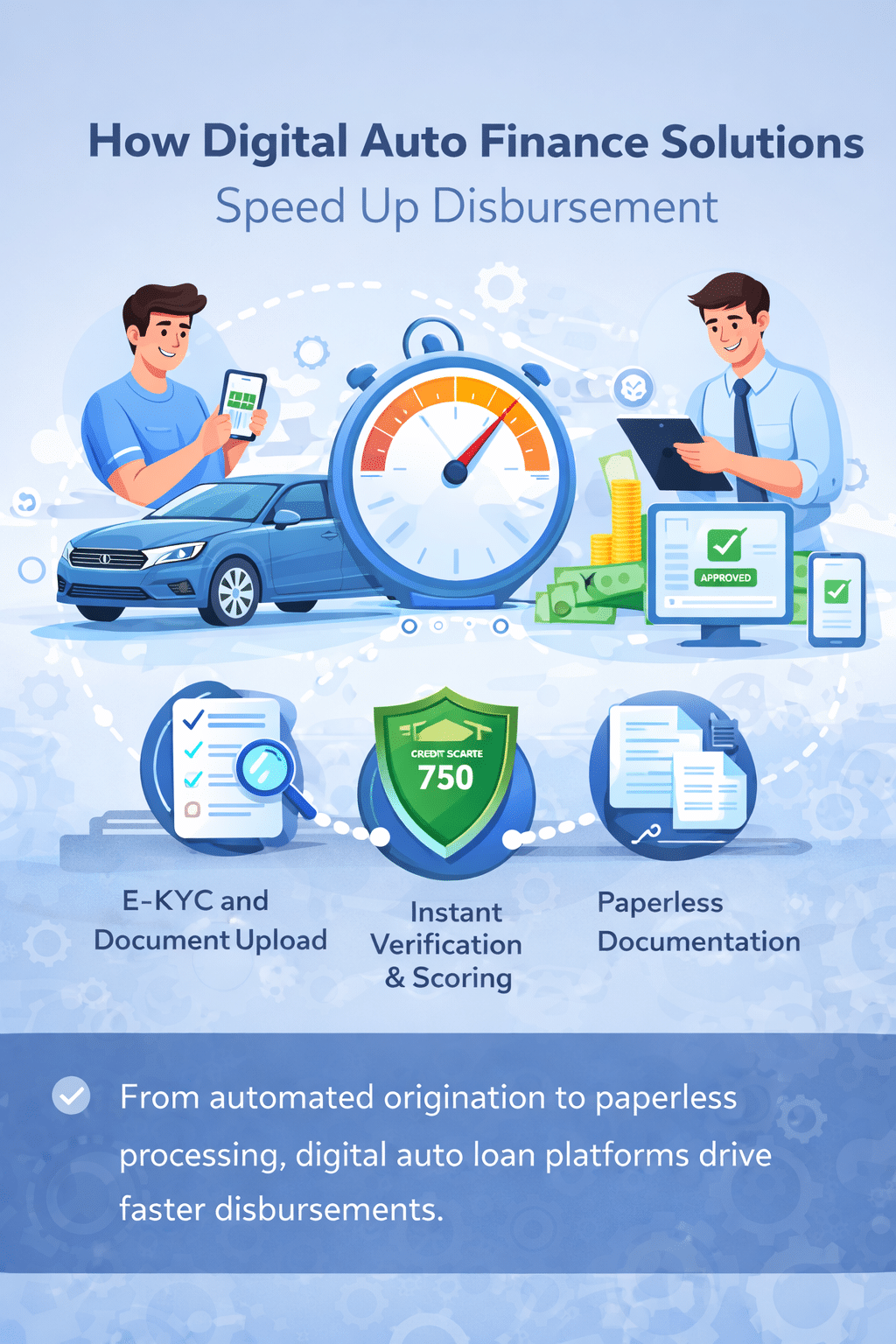

How Digital Auto Finance Solutions Speed Up Disbursement

With digital auto finance platforms, and those based on auto loan software, in particular, speed is the result of:

1. Automated Origination

From loan application to credit decision, digital solutions automate the entire loan origination process. Features include:

- E-KYC and document upload

- Real-time credit bureau checks

- AI-driven eligibility scoring

This cuts down turnaround times significantly versus paper-based systems, where submitting documents physically and manual review can slow things up a lot.

2. Instant Verification and Scoring

APIs that hook into credit bureaus let lenders evaluate risk in real time. Verification and scoring, instead of days, could take only hours, dramatically reducing the time it takes to dispense funds.

3. Paperless Workflow

Digital lending platforms do away with all the paperwork involved manually. Borrowers can deposit documents via mobile or web portals, thus speeding processing time and avoiding errors.

4. End-to-End Digital Journey

Platforms such as Maruti Suzuki Smart Finance are a testament that full digital journeys – right from the application of a loan to sanction and disbursal – enable customers to apply for their ride finance digitally with real-time tracking.

Comparative Table: Traditional vs Digital Auto Loan Processing

| Feature | Traditional Loan Processing | Digital Auto Finance Solutions |

| Document Submission | Physical documents required | Digital upload via portal/app |

| Credit Verification | Manual takes days | Automated, real-time |

| Approval Time | Several days to weeks | Hours to the same day |

| Disbursement Speed | Delayed due to manual checks | Immediate or near-instant |

| Customer Visibility | Limited tracking | Real-time status updates |

| Operational Cost | High labor and overhead | Reduced via automation |

Real-World Example

One of the popular tales in India is of Maruti Suzuki Smart Finance that has crossed a staggering 2.5 million digital auto loan disbursals, raising insights about how customer buy-in swells when made easy and digital!

According to Partho Banerjee, Senior Executive Officer (Marketing and Sales), Maruti Suzuki India, stated:

“Today’s car buyers begin most of their purchase journeys online, sifting through models and financing options long before they show up on a lot. While digital financing solutions changed the way customers interact with us, with seamless, transparent and fully digital processes, which is an amazing achievement.”

This feeling is an expression of the fact that digital channels have transformed from optional to imperative in auto finance.

Challenges and Considerations

While digital auto loan solutions come with their share of benefits, it’s important to consider a few challenges:

- Digital Literacy: Some borrowers may not be at ease with the online channel.

- Data Protection: Platforms need to focus on security.

- Regulatory Compliance: Continued software infrastructure updates for financial regulations that are always ongoing.

- Data Quality: The efficacy of AI-based credit scoring makes accurate and quality data a requisite.

Despite those concerns, the best auto loan software companies weave secure authentication, compliance frameworks and scalable infrastructure into their solutions to cause as little risk and friction as possible.

Future Trends in Digital Auto Financing

As we look forward, digital auto finance will further morph based on these burgeoning technology drivers:

- AI and Predictive Scoring: Tailored loan offers and risk scores.

- Verification on the Blockchain: Unchangeable records for quicker approvals and security.

- Mobile-First Platforms: Apply & receive loans as you go.

As per digital lending studies, when loan processes are automated using solutions like Straight-Through Processing (STP), operational efficiencies and borrower experience increase manifold.

Conclusion

Digital auto financing software is turning the world of auto loans upside down–changing how they are initiated, approved, and funded. Borrowers enjoy access to funds more quickly and gain greater transparency throughout the process, from automated originating to instantaneous credit scoring. Lenders, for their part, get processes that are simplified and shortened — as well as an advantage over old-school competitors mired in slow manual activity.

Use of modern auto finance software, auto loan software no longer a privilege, the use of modern auto finance software and auto loan software solutions has become a necessity for financial organisations to stay competitive in today’s age of digital banking. The staggering success of platforms such as the Maruti Suzuki Smart Finance — hovering over millions in digital disbursals – does not even cover half of how strong it is with their efficacy in auto lending by digital disruption.

In an industry that is rapidly changing, digital acceleration is the next frontier for efficient and customer-focused strategies in auto loan disbursal. And if businesses want to leverage these benefits with precision and reliability, then Jaguar Software India has established itself as a reliable ally in ensuring the deployment of state-of-the-art Digital Auto Finance Solutions that promise speed, performance and growth for auto finance operations.

FAQs

Is auto finance in software safe for applying for a loan?

Yes, with the latest security features, such as encryption, secure authentication, and default regulatory compliance. Such systems safeguard customer information and help satisfy financial and legal requirements established by regulators.

What Makes Digital Auto Loan Processing Different From Traditional Ways?

The documentation and physical verification are a heavily manual process in traditional auto lending, which unnecessarily causes delays. Digital Auto Finance Solutions leverage efficient automated workflows, live credit bureau integration and paperless documentation to reduce turnaround times and enhance accuracy.

Will digital auto loan software help boost approval odds?

Auto loan software applies data analytics and alternative credit scoring models to qualify borrowers in a more precise manner. This enables lenders to service creditworthy customers that otherwise would be missed, while keeping approval rates at or above current levels.

Do customers have to go into a bank or dealership still?

In most cases, no. Now, with Digital Auto Finance Solutions, customers can transact all aspects of a loan online – from application to disbursement. Physical contact can be needed only in some regulatory or identification processes.