The modern situation in Indian finance has changed due to the fact that ongoing operations no longer follow their preceding sample. The procedure of borrowing and lending money these days experiences an entire transformation in the course of Mumbai and the growing technological centres of Tier-2 cities. People used to suppose that obtaining a loan required them to finish tremendous documentation and wait numerous days till they received a response through smartphone conversation. The contemporary international operates in accordance with 3 crucial values, which consist of velocity, transparency, and accessibility. The generation you select capabilities these days as the core system in your enterprise operations, whether you’re a FinTech startup or a longtime NBFC that calls for market competitiveness. Jaguar 360° Cloud capabilities as a technique to address this hassle. The Indian digital lending software features as a complete system that permits customers to manage the intricate requirements of present-day Indian monetary situations. Here in this blog, we provide you the complete information about What is Jaguar 360° Cloud? A Complete Guide to India’s Next-Gen Digital Lending Platform.

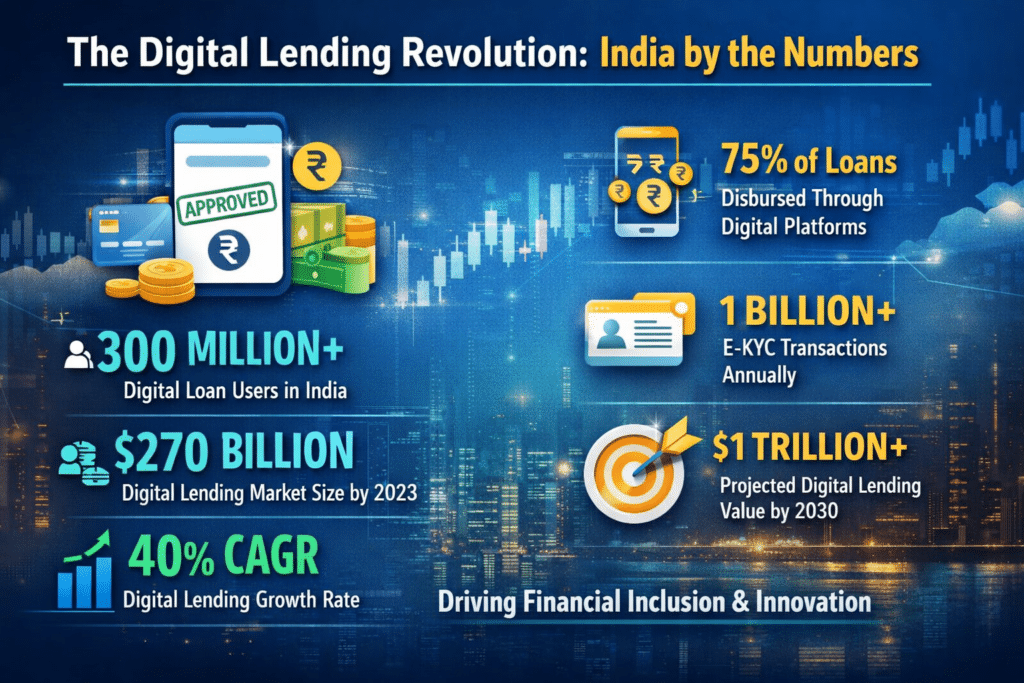

The Digital Lending Revolution: India by the Numbers

The shift closer to digital platforms isn’t just a fashion because overwhelming evidence supports its life. The Indian digital lending marketplace will achieve an incredible increase through early 2026 through the mixture of UPI and the AI era and regulatory backing.

- Market Size: India’s digital lending marketplace will attain a fee between $350 billion and $515 billion by using 2030, in keeping with modern-day market projections.

- Adoption Growth: NBFC-FinTechs have shown their origination volume percentage for private loans has jumped to nearly 90% as of Q1 FY26.

- Efficiency Gains: Lenders have carried out their KYC client acquisition expenses reduction via virtual device implementation, which decreased prices by means of eighty five%.

- Growth Rate: The digital lending platform marketplace in India suggests a continuous growth rate of about 31.5% until the yr 2030.

“The technique of selecting a lending platform nowadays requires groups to make architectural selections as a substitute of selecting between technological alternatives. Lenders need to put into effect structures that preserve their monetary value whilst commercial enterprise operations scale.” – Industry Insight, 2026

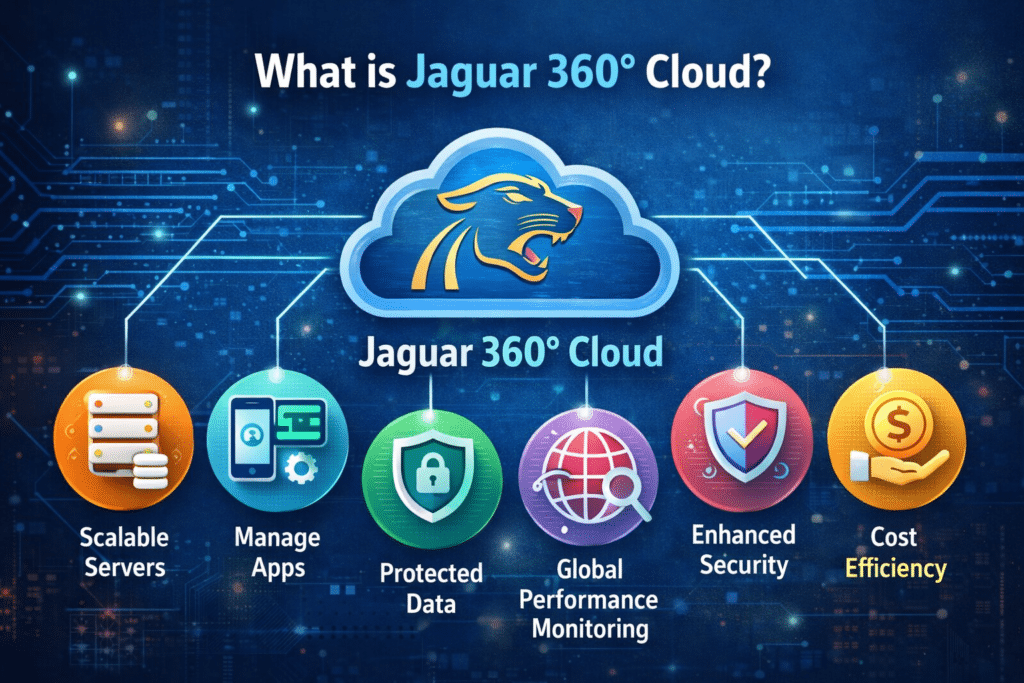

What is Jaguar 360° Cloud?

Jaguar 360° Cloud is also known as a digital lending platform that helps in managing the whole loan lifecycle from lead generation and onboarding to disbursal, servicing, and collections. It serves as an ERP++ solution and also provides much more than just a database for records, which is developed by the experts at Jaguar Software India.

This platform is different because it provides a combination of Business Process Management with advanced automation. This will help lenders to design their credit appraisal workflow visually using a flowchart-based interface. In that case, if you want to launch a new Gold Loan or MSME product, you don’t need to write any lines of code; all you need is to simply adjust the workflow and go live.

Comparative Analysis: Jaguar 360° Cloud vs. Traditional Systems

If you want to understand why a digital lending platform like Jaguar 360° cloud is important, then we provide you with the complete details through a table tha compare how many institutional legacy systems are struggling to move away from.

| Feature | Legacy Lending Systems | Jaguar 360° Cloud |

| Onboarding Time | 3 to 7 Days | In Minutes |

| Product Launch | 3 to 6 Months | 2 to 5 Days |

| Scalability | Limited by physical hardware | Unlimited |

| Compliance | Manual reporting | Automated RBI returns & audit logs |

| Customer Experience | Physical visits required | 100% Digital |

| Risk Management | Historical data only | AI-powered predictive risk modeling |

Core Components of the Platform

1. Loan Origination System (LOS)

This system helps in handling everything from lead management to the final approval. It also integrates with credit bureaus like CIBIL, Experian, PAN validation, and Bank statement analyser, which helps in 360 degree view of the borrower’s profile instantly.

2. Loan Management System (LMS)

LMS manages flexible EMI schedules, top-ups, and automated restructuring. The LMS also keeps the ledgers clean and synced, whether it is a small ticket personal loan or a complex MSME asset finance deal.

3. Smart Collections

Jaguar 360° Cloud is here to provide the right collection bucket with the use of AI to classify delinquent customers. It also tracks promise to pay and automates follow-ups, which helps in reducing NPAs.

Why “360° Cloud” Matters for Indian Lenders

The time period “360°” within the call functions as more than a promotional time period. The time period offers complete visibility of commercial enterprise operations. Jaguar 360° Cloud gives additional value to creditors through its internal health evaluation machine, which extends beyond trendy borrower assessments.

- Integrated General Ledger: The platform serves as one of the few financial accounting structures that consists of a standard ledger device at this stage of operation.

- Channel Partner Management: The gadget enables control of Direct Sales Agents and referral sellers from their initial training until they acquire their fee bills.

- Co-Lending Engine: The device allows banks and NBFCs to work together through its real-time API records synchronisation and compensation cut-off abilities.

Conclusion

The success of a lending business in 2026 requires it to adapt to each new policy and changing customer needs. The Jaguar 360° Cloud device enables firms to gain the required operational flexibility. Financial establishments ought to pick virtual lending software that combines automation with AI and cloud scalability because this technique allows them to focus on their core business of portfolio growth.

Jaguar Software India operates all over India, while possessing twenty years of enterprise know-how to set up new standards for era-based answers in the financial quarter. The manner of reworking your lending operations into a virtual-first powerhouse begins with selecting the best platform.

FAQs

I already have a system in place. How hard is it to switch to Jaguar 360° Cloud?

We know that switching systems feels like an open heart surgery for your business. But don’t worry, Jaguar Software India is for you. We use a sequential implementation approach, which also helps you to migrate your data using preset templates, and run the new system with your old one to make sure that there is zero downtime. Most of our clients are up and running without a hitch within a few weeks.

Can the platform handle specific RBI mandates like the new 2026 digital lending guidelines?

Yes, of course. This platform is updated constantly to generate the mandatory Key Fact Statement for every borrower to automate NPA reporting and real-time audit trails by complying with the latest RBI circulars. You don’t have to worry about any manual compliance checks.

We want to launch a new ‘Green Energy/EV’ loan product next month. Is that possible?

Absolutely. You do not need to wait for a developer to write new code. You only do is simply draw your new loan workflow on a digital canvas and set your interest rules, and you are good to go. The new vertical launching can happen in just 2 to 5 days.

Is my data safe on a digital lending platform?

Don’t worry about anything because security is our top priority. The digital lending platform uses bank-grade encryption, role-based access control, and the hosted environment is also secure. We also follow the industry best practices like PCI-DSS and GDPR standards to make sure that your data and your customer data are ironclad.