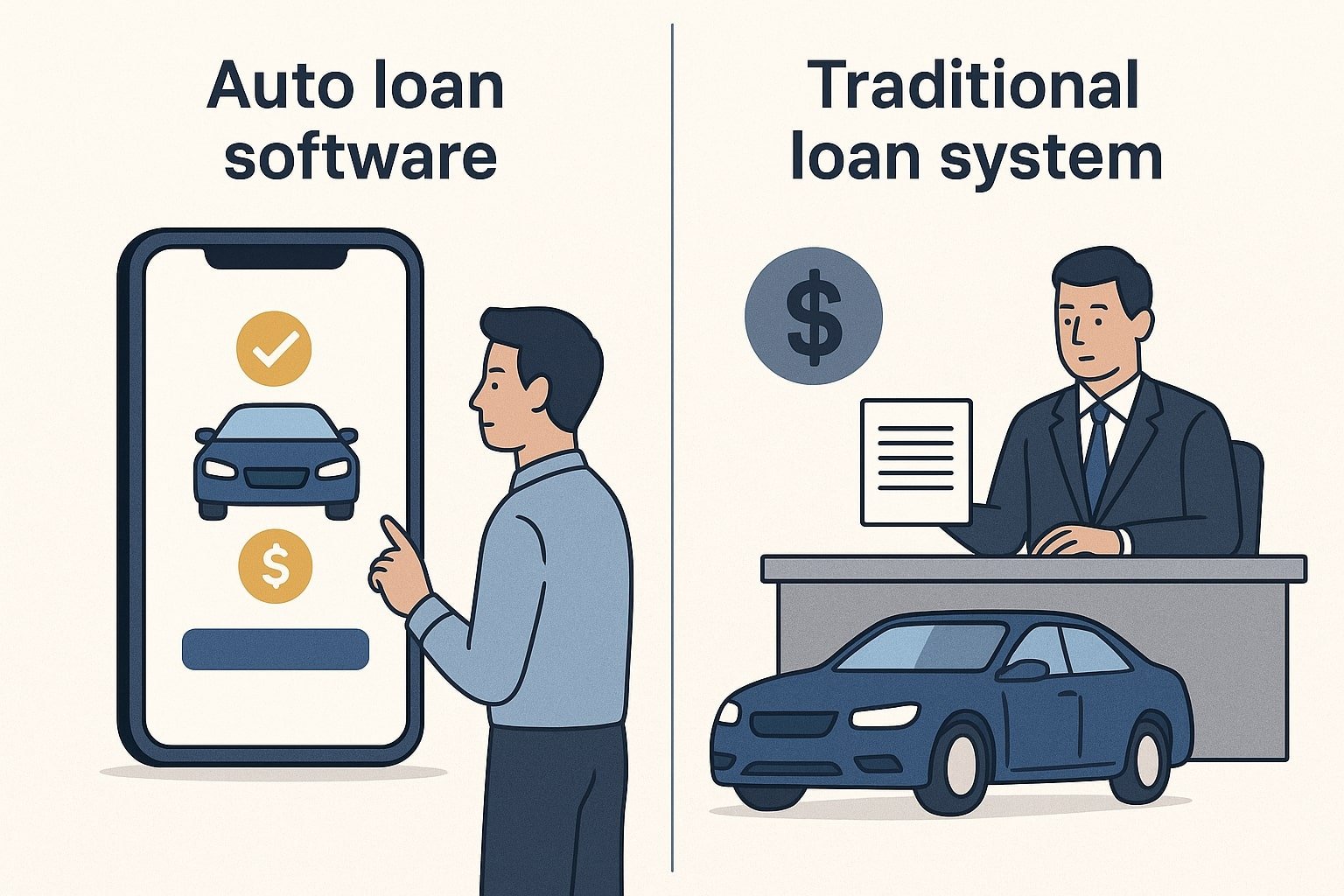

As the world is moving towards automation, AI, and faster technology, different sectors have started to shift from traditional processes to automated processes. The banking and financing industry has seen a huge shift from traditional loan processes to auto loan management software. With the introduction of the auto loan software, it has transformed the way in which loan applications are handled.

In this blog, we will talk about the difference between Auto Loan Management Software and Traditional Systems and decide which one is better for your institution. If you are a bank, NBFC, or a leading company, you need to understand the key difference so that you can make the right choice.

Key facts

- According to Jaguar Software India, automating auto-loan processing can cut approval times by 50–70%.

- According to UiPath, using auto loan software helps in reducing overall processing time by up to ~55%.

- According to totality, fewer human errors are made by using loan management software.

- The global auto-loan market is estimated to be worth USD 1.84 trillion in 2025. Morder intelligence.

- The size of the auto-loan market in India is projected at USD 43.45 billion in 2025 and expected to grow to about USD 61.13 billion by 2030. Morder intelligence.

Understanding the Traditional Loan Management Software

In the traditional loan management system, all the processes of a loan lifecycle are manual. From application, document verification, to loan approval and disbursal, everything is paper-based, delivered by the employees.

These processes were in use for a long time but had limitations. Therefore, an automatic loan management system was required to streamline and speed up the process.

Drawbacks of Traditional Loan Systems

Processing Time

Due to the manual checks and verifications, the loan lifecycle process takes several days to finally approve the loan and then another 2-3 days for disbursal.

Risk of Human Errors

As calculations for the interest rates, loan lifecycle days, data entry, and document verifications are done manually, it involves a high risk of wrong customer details, inaccurate interest rates, and not unable to detect fake documents.

Less transparency

Customers do not have access to their loan application. Also, there is no centralized system to check the loan application at different stages of the loan lifecycle. There is no system to track the payments and EMI due dates.

Operational cost

The traditional loan process involves high operational costs. As all the steps are manual, you need more employees to perform the daily tasks. Basic tasks or repetitive tasks are handled by the employees.

Poor Customer Experience

The customer had to visit the branch again and again to fill in the details and to do other tasks. This takes a lot of time. It creates a bad customer experience.

Understanding the Auto Loan management software

In the Auto Loan Origination software, all the manual steps are automated. From the application process to loan disbursal, KYC, and others, everything is digital. Auto Loan Origination software involves the following features

- Processing online Loan applications

- Through fully automated KYC/document verification

- Real-Time Credit Assessment

- Automated Loan Agreement Processing

- Automated EMI Reminders and Collection

- Configurable dashboards and reports

- eKYC+eSign functionality

- Secure Management of Customer Data

- Digital Loan Tracking for Lenders and Borrowers

Why are lending firms accepting the auto loan software instead of traditional loan software?

Let us compare and look at why everyone wants to shift towards the Auto loan software

| Features | Auto loan software | Traditional loan system |

| Processing Speed | Loans approved in minutes and disbursed in hours | Very slow process, loan approval and disbursal are done in 5-6 days. |

| Accuracy | Highly accurate, and no manual steps are followed | High chance of eros due to manual steps |

| Customer Experience | Online application, easy access from anywhere. No need to visit the branch | Branch visits are, slow process, and more prone to errors. |

| Risk & Fraud detection | Strong digital checks, automated identity verification, and AI-based fraud detection | Weak detection due to manual checks; higher fraud risk |

| Operational Efficiency | Reduces workload; automation handles repetitive tasks | Time-consuming manual processes; high manpower needs |

| Scalability | Thousands of applications are easily handled | Not easy to scale, needs more manpower to deliver the work |

| Cost-Effectiveness | Lower operational costs after setup; high productivity | Higher long-term cost due to manpower, paperwork, and delays |

| Document Handling | Digital storage, eKYC, eSign, automated document verification | Paper files, physical storage, high chance of lost documents |

| Reporting & Analytics | Real-time dashboards, automated reports, predictive analytics | Manual reporting lacks accuracy and real-time data |

| Compliance & Audit | Audits are done automatically | Manul checks, not reliable |

| Data Security | Secure, encrypted | Not secure, risk of misplacement |

| EMI & Collection Tracking | Automated reminders, digital payment tracking | Manual follow-ups and reminders; higher default chances |

| Customer Reach | Accepts online applications from anywhere | Limited to local or walk-in customers |

What are the top 5 main benefits of the Auto Loan Management software?

Let us look at the top 5 benefits

- The main benefit is faster loan approval. It saves time, money, and provides a better customer experience.

- Can apply for a loan from the comfort of your home through the application. Every step is digital.

- It is more secure, and data is encrypted. It is safe; each action is noted through the automated backup.

- Frauds are detected in a much better way. This avoids fake documents, fake identity proofs, and avoids turning loans into NPAs.

- A happy customer is a retained customer. Customers become loyal to your firm throughout the year and for decades.

Block quote

Automation delivers the speed and accuracy traditional loan systems can’t match.

Conclusion

We have clearly highlighted the key difference between the traditional and automatic loan systems. It clearly shows that adopting auto loan software is the best choice for the institutions and for the customers. If you are a lending company, bank, NBFC, or auto loan company, having an auto loan software will do wonders for your company.

Jaguar Software India offers customized auto loan management software tailored to your business needs.. To have the complete information, you can visit on the contact details mentioned below.

Contact details

Company Name – Jaguar Software India

Phone No – +919666107000

Address – 18-19, Rajinder Nagar, Police Lines Road, Jalandhar, India

Email – info@jaguarsoftwareindia.com

Website – https://jaguarsoftwareindia.com/

Frequently asked questions

Which company sells the auto loan software in india?

Jaguar Software india sells the auto loan software in india at reasonable prices.

When can we use the traditional loan system in the leading industry?

If you are on a low budget, have a few loan applications to handle, and prefer manual workflows, you can choose the traditional method. Sooner or later, you will have to shift towards the auto loan software.

Can small-sized lending companies use auto loan software?

Yes, all-sized firms can use the auto loan software. It benefits small-sized firms by automating the process and helping them onboard more customers, which increases their revenue.

What is the cost of the Auto loan management software?

The cost of the auto loan origination software depends on several factors. Our experts at the company can understand your requirements and then suggest to you the customized software at the most reasonable prices.

Can customer track their online payments, EMIs in the auto loan software?

Yes, it is transparent, everything is visible, and you can track loan applications, EMIs, and everything.