Solutions We Offer

Home » Solutions

Versatile Auto Finance From old vehicles to new…

Read moreTailored to customer segments, our personalized loan products…

Read moreSmall to Big Ticket Loans. Fixed or Floating…

Read moreOur loan against property software caters to a…

Read moreElectric Vehicle finance with schemes, dealer management, Vahan…

Read moreMSME to Big Ticket Loans . Secured or…

Read moreSet credit limits on Customers. Interest is charged…

Read moreVersatile Home Loans Small to Big Ticket Loans…

Read moreVersatile Gold Loans Personalised Loan products as per…

Read moreVersatile Education Loan Multiple Loans or Single Account…

Read moreMany flexible repayment options suitable for Agri-loans like…

Read moreVersatile Machinery Loans MSME to Big Ticket Loans…

Read moreVersatile Supply Chain Finance Sales/ Purchase/ Anchor Bill…

Read moreVersatile Microfinance / Group Loans Personalised Loan products…

Read moreVersatile Wholesale Loans Big Ticket size (500 crores)…

Read more

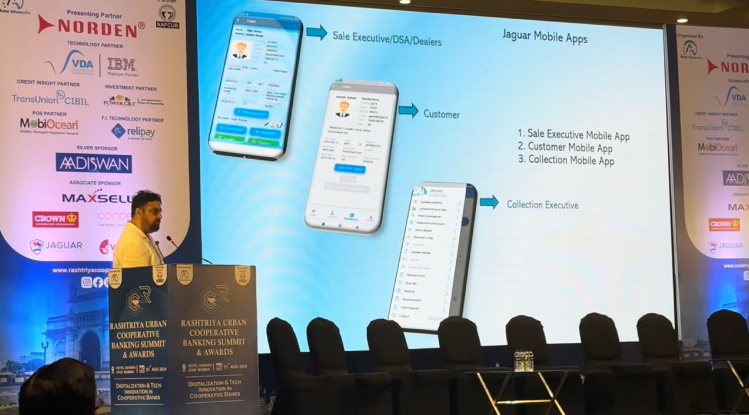

eKYC Mobile Apps with bureau integration and automated approvals.

Workflow management and automation of underwriting.

End-to-end management of loans: initiation to closure.

Workflow management and automation of underwriting.

End-to-end management of loans: initiation to closure.

Effective receivables and recovery management.

It involves loans, deposits, GST, and TDS.

Team chat, task management, calendar, and contact sync.

Tracking of assets and liabilities.

Bank is automated and includes receipts, payments, renewals, and reporting.

Give your organization a fully digital customer onboarding, credit, and underwriting solution fully powered by an advanced BPM (Business Process Management) workflow platform.

You can automate, amend, and design easily with our drag-and-drop designer. Added or deleted tasks, set rules, and unlimited process design, without a single line of code.

Give your organization a fully digital customer onboarding, credit, and underwriting solution fully powered by an advanced BPM (Business Process Management) workflow platform.

You can automate, amend, and design easily with our drag-and-drop designer. Added or deleted tasks, set rules, and unlimited process design, without a single line of code.

Jaguar 360° Cloud streamlines loan origination with a flowchart-based process design, providing flexibility for diverse scenarios. Integration with APIs enables seamless data submission to co-lenders, fostering collaboration and efficiency. This approach ensures smooth operations and enhances decision-making in the loan origination phase.

Read moreOur lending solution covers the entire lifecycle, from disbursement to closure, offering integrated financial accounting, scheduled disbursal, and diverse repayment options like EMI, scattered installments, and moratoriums. With flexible installment frequencies from daily to yearly, it ensures accurate income recognition, efficient repayment, and meticulous handling of PDCs, ACH, and late payments. It manages NPAs, provisioning, closure details, including NOC register and post-disbursal document management, and provides robust MIS capabilities, multi-lingual support, SMS integration, and seamless CIBIL data submission.

Read moreOur lending solution covers the entire lifecycle, from disbursement to closure, offering integrated financial accounting, scheduled disbursal, and diverse repayment options like EMI, scattered installments, and moratoriums. With flexible installment frequencies from daily to yearly, it ensures accurate income recognition, efficient repayment, and meticulous handling of PDCs, ACH, and late payments. It manages NPAs, provisioning, closure details, including NOC register and post-disbursal document management, and provides robust MIS capabilities, multi-lingual support, SMS integration, and seamless CIBIL data submission.

Read moreInvolves all modules and over 15 or more lending verticals.

Visual flowcharting of the process.

Mobile apps, dashboards, and advanced analytics.

Tested reliability and accuracy.

Scalable prices for the growing business.

Data protection at the enterprise level.

With us you’re in safe hands – you’ll never get stuck due to lack of features. If you require a feature that is not present, we’ll develop it for you. We really want our customers to succeed and go the extra mile

For charges, we make a case by case judgment. For some small features or widely applicable enhancements, we might provide it for free. For other customizations, we will charge you a reasonable amount, but you’ll always be able to get the feature

We carefully understand your business requirements, our experts match it with our deep domain expertise, and come up with elegant solutions that handle the business case well – usually exceeding the customer expectations

Loan software automates and streamlines the lending process, from application to approval and disbursement. It enhances efficiency, reduces errors, and provides better visibility into loan portfolios, ultimately saving time and improving decision-making.

Yes, our loan software is highly customizable. We work closely with each client to understand their unique lending processes and requirements, ensuring that the software is tailored to meet their specific needs.

We prioritize the security of our loan software and adhere to industry best practices for data protection. Our software features robust encryption, secure access controls, and regular security updates to safeguard sensitive customer information.

We have complete logging feature as per banking standards, as required by RBI from 1 April 2023.