Loan origination systems are at the core of lending operations in this day and age, enabling financial companies to automate, safeguard, and increase their loan application and approval processes. In the year 2025, with the digital transformation process going on at an accelerating pace and regulatory requirements being more stringent, a good loan origination software will not be just an automation device but a smart, flexible, and future-ready one. The market for global loan origination software will be worth USD 6.58 billion in 2025, with a CAGR of about 12.1%. The trends point out that a strong LOS has become a very important factor for banks, fintechs, and even gold-loan providers who want to be in a good competitive position.

The article discusses the 12 essential features that will characterize an excellent LOS in 2025, which is to say that these features will be particularly important whether you are using the traditional loan workflow or the specialized gold loan software, and also makes a comparison of different systems regarding these features. Besides that, we are going to talk about the new technologies that are driving LOS innovation and the way businesses can select the right solution according to their needs.

Key Facts at a Glance

- The global sale of loan origination software is predicted to expand and reach almost USD 6.58 billion in 2025.

- Research has indicated that the LOS market would maintain a vigorous growth rate of 14.8% in the years 2025 to 2034.

- Future Market Insights claims that under a 13% CAGR, the market could swell to USD 21.78 billion by 2035.

- As of now, there are 11.5 million consumer finance loans originated this year, which is 7.6% higher than the figure for 2024.

12 Must-Have Features of a Good Loan Origination System

Here are the 12 important features any modern LOS should include:

#1 AI-Powered Underwriting & Credit Scoring

The application of AI and machine learning has made it possible to assess the credit risk more correctly, uncover fraudulent activities, and make decisions faster. Among the notable trends, AI has the potential to radically change the loan origination system (LOS) in 2025.

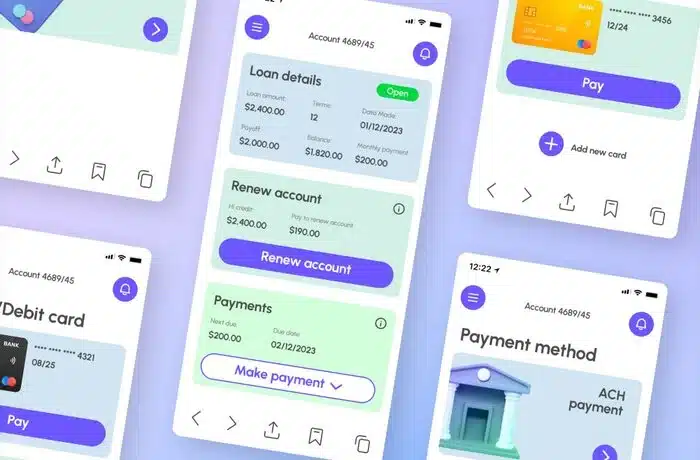

#2 Intuitive, Mobile-First UI / Borrower Portal

To decrease application drop-offs and enhance form completions, consider a borrower’s straightforward, user-friendly interface with mobile optimization.

#3 Configurable Workflow & Loan Product Engine

Credited are the lenders with having to edit and create loan products, personal, mortgage, car, or gold loans-and workflows to suit their operational model.

#4 Document Management & e-Signing

Automating the collection of information, its verification, as well as its e-signature acceptance, reduces the load of paperwork, saves time by preventing human errors, and facilitates the swiftness of carrying out tasks.

#5 Integration with Credit Bureaus / KYC / AML

Incorporating external systems for credit checks, identity verification (KYC), and AML verification will ensure compliance and reduce risk.

#6 Automated Rules Engine

With the help of a rules engine, financial institutions can transform their underwriting policies, compliance rules, and business logic into code, which brings about quicker and more uniform decision-making at the same time.

#7 Risk Analytics & Reporting

Underwriters and managers are enabled to track significant metrics and rely on facts while making decisions with the help of the built-in dashboards for reporting risks, pipelines, and performance.

#8 Cloud Deployment & Scalability

The cloud-based LOS platforms have a clear advantage in the new deployments, as more than 60% of LOS installations in 2024 will be in the cloud. Cloud deployment not only reduces hardware expenses but also allows for easy scaling.

#9 Security & Data Privacy

In particular, loans that are regulated will not accept any compromises regarding strong encryption, control of access based on roles, and adherence to the rules of data sovereignty.

#10 API & Third-Party Integration

An up-to-date LOS should be able to communicate with the CRM systems, different loan servicing platforms, payments gateways, and even newcomers like Web3 or blockchain technologies. As per the market study, the need for customizable, cloud-based platforms that are able to handle various loan products still persists and is increasing.

#11 Automation & RPA (Robotic Process Automation)

RPA software robots will be able to do tasks that humans find boring, like entering data, verifying documents, and conducting background checks, thus liberating the human workforce to carry out tasks with more value.

#12 Audit Trail & Compliance Features

Compliance regulation and the need for internal governance both beautifully encapsulate the salient essence of logging who did what at any given instant.

Comparative Overview

Here is how different types of LOS stack up against these features:

| Types of LOS/Use-Case | Strengths | Potential Limitations |

| Cloud-native LOS | Highly scalable, fast to deploy, lower capex | May raise concerns around data privacy or regulatory compliance in certain geographies |

| On-premises LOS | Full data control, better for institutions with legacy systems | Requires a large upfront investment, less flexibility to scale or integrate |

| Specialized LOS (e.g., gold loan software) | Tailored rules engine for gold-asset valuation, relevant compliance modules | May lack broad functionality for other loan types; risk if limited integration |

Why These Features Matter

- Efficiency and Speed: Industry analysis draws a conclusion of up to 40% reduction in decision time, which is fully credited to AI-assisted underwriting and document workflows that are automated.

- Risk Management: Through real-time analytics, lenders can detect fraud earlier, manage pipeline risk, and remain compliant with regulations.

- Scalability: The API-first infrastructure of a cloud-based LOS makes scaling of operations easy, launching new loan products (like gold loans), or entering new markets without any problem.

- Customer Experience: Speedy, digital, and clear processes are the minimum expectations of the borrowers. The LOS providing mobile apps and e-signature support adds to customer satisfaction significantly.

Real-World Insight

The technology of “AI that can indeed read and comprehend the disheveled papers that banks deal with daily” has transitioned from handling only about 15 applications each month to more than a hundred every day, thanks to the fact that teams are no longer inundated with data processing.

Final Thoughts: Choosing the Right LOS in 2025

The choice of an LOS is not simply a matter of deciding on one software package over another—it is an alignment of technology with your business objectives, compliance requirements, and growth strategy. It does not matter if you are a traditional bank, a fintech company, or a business that primarily offers gold loans; the tips given below are all designed for practical use.

- The first step is to pinpoint your loan products, workflows, and pain points.

- Then make a list of the top LOS vendors that offer configurable rules engines and API integration so that your system can be adjusted to accommodate the business changes that will come with its growth.

- Consider cloud vs. on-premise deployment from the perspective of your data security policies, regulatory requirements, and plans for scaling.

- Perhaps you could try and get the case studies, particularly those involving your niche (like gold loan software), as proof of how the LOS works in the real world.

At Jaguar Software India, we are committed to delivering tailor-made, cutting-edge LOS solutions. A powerful loan origination system should not only simplify processes but also give you the power of intelligence, flexibility, and compliance—all of which are at the heart of the platform. With the LOS knowledge of Jaguar Software India at your disposal, your institution will be able to enlarge its potential, handle risks more wisely, and deliver a first-class borrower experience in 2025 and beyond.

FAQs

How do I know what makes a good Loan Origination System in 2025?

In simple terms, a great loan origination system must have the following features: an AI-based system, be ready for the cloud, be scalable, be safe, and be fully customizable. This will lead to less manual work, faster approvals, easy integration with your current tools, and compliance support that does not require extra effort, which is a strong indication of choosing the right one.

Does a modern LOS support different types of loans, including gold loans?

Yes, of course, modern LOS platforms support multiple loan products. If you are handling gold loans, make sure the LOS comes with valuation modules, rule-based lending parameters, risk scoring, and audit trails. Many institutions prefer LOS platforms that can also work as dedicated gold loan software so they can serve more borrowers without switching systems.

How much automation should I expect from a reliable LOS?

The Loan Origination System should take over the process of gathering all required documents, underwriting, checking risks, verifying KYC/AML compliance, and even doing standard follow-ups. In case the system is still requiring numerous manual entries from you or you have to deal with duplicating data, then it might be an obsolete one. The process of automating is the one that quickens acceptance and minimizes mistakes caused by human beings.

Is AI really necessary in an LOS, or is it just hype?

As you know, AI is no longer optional. Modern lenders use AI to assess creditworthiness, flag inconsistencies, predict risk, and process documents faster. If you want faster loan decisions and more accurate risk assessments, AI-enabled underwriting is a major advantage.